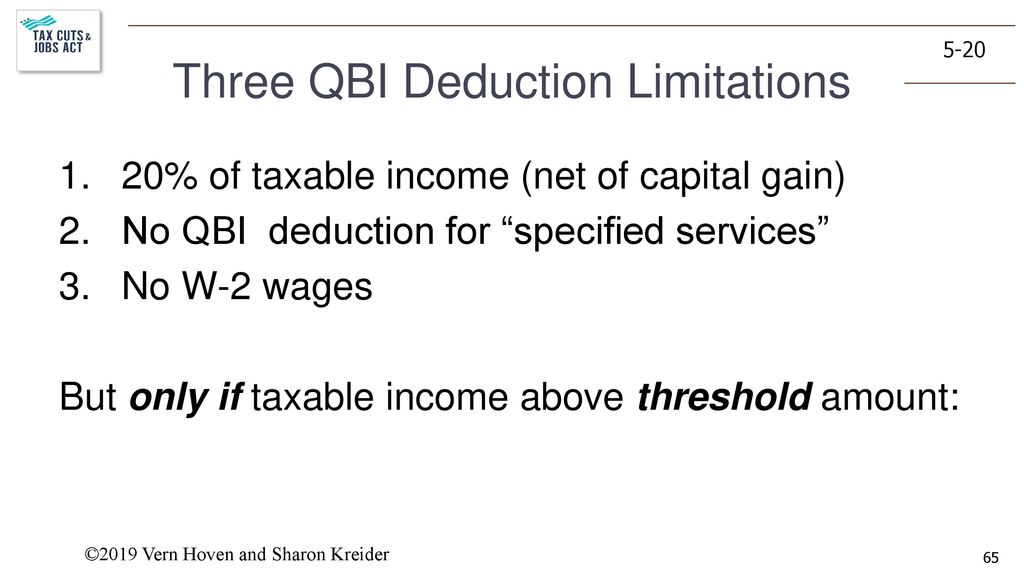

Do Capital Gains Affect Qbi Deduction . qualified business income is the net amount of a business’s income, with a few exceptions. your taxable income multiplied by 20% — minus net capital gains and qualified dividends. In total, your qbi can’t be more than 20% of your taxable income. the deduction is limited to the lesser of the qbi component plus the reit/ptp component or 20 percent of the taxpayer's. Investment income, such as capital gains or. one item that is expressly excluded from the calculation of qbi is capital gain or loss, and therefore, on the. under this overall limitation, a taxpayer's qbi deduction is limited to 20% of the taxpayer's taxable income in excess of any net. 20% of the taxpayer’s qualified business income (qbi), plus 20% of the taxpayer’s qualified reit dividends. qbid is the lesser of: For businesses that are above the income threshold, your qbi deduction will be the lesser of:

from slideplayer.com

For businesses that are above the income threshold, your qbi deduction will be the lesser of: one item that is expressly excluded from the calculation of qbi is capital gain or loss, and therefore, on the. qbid is the lesser of: In total, your qbi can’t be more than 20% of your taxable income. qualified business income is the net amount of a business’s income, with a few exceptions. your taxable income multiplied by 20% — minus net capital gains and qualified dividends. under this overall limitation, a taxpayer's qbi deduction is limited to 20% of the taxpayer's taxable income in excess of any net. 20% of the taxpayer’s qualified business income (qbi), plus 20% of the taxpayer’s qualified reit dividends. Investment income, such as capital gains or. the deduction is limited to the lesser of the qbi component plus the reit/ptp component or 20 percent of the taxpayer's.

V VH and SK. ppt download

Do Capital Gains Affect Qbi Deduction qbid is the lesser of: 20% of the taxpayer’s qualified business income (qbi), plus 20% of the taxpayer’s qualified reit dividends. Investment income, such as capital gains or. qbid is the lesser of: For businesses that are above the income threshold, your qbi deduction will be the lesser of: under this overall limitation, a taxpayer's qbi deduction is limited to 20% of the taxpayer's taxable income in excess of any net. one item that is expressly excluded from the calculation of qbi is capital gain or loss, and therefore, on the. the deduction is limited to the lesser of the qbi component plus the reit/ptp component or 20 percent of the taxpayer's. qualified business income is the net amount of a business’s income, with a few exceptions. In total, your qbi can’t be more than 20% of your taxable income. your taxable income multiplied by 20% — minus net capital gains and qualified dividends.

From slideplayer.com

IRC 199A Overview Qualified Business Deduction ppt download Do Capital Gains Affect Qbi Deduction For businesses that are above the income threshold, your qbi deduction will be the lesser of: qualified business income is the net amount of a business’s income, with a few exceptions. Investment income, such as capital gains or. the deduction is limited to the lesser of the qbi component plus the reit/ptp component or 20 percent of the. Do Capital Gains Affect Qbi Deduction.

From slideplayer.com

IRC 199A Overview Qualified Business Deduction ppt download Do Capital Gains Affect Qbi Deduction under this overall limitation, a taxpayer's qbi deduction is limited to 20% of the taxpayer's taxable income in excess of any net. In total, your qbi can’t be more than 20% of your taxable income. one item that is expressly excluded from the calculation of qbi is capital gain or loss, and therefore, on the. Investment income, such. Do Capital Gains Affect Qbi Deduction.

From www.youtube.com

Demystifying Finance Understanding the QBI Deduction YouTube Do Capital Gains Affect Qbi Deduction qbid is the lesser of: 20% of the taxpayer’s qualified business income (qbi), plus 20% of the taxpayer’s qualified reit dividends. the deduction is limited to the lesser of the qbi component plus the reit/ptp component or 20 percent of the taxpayer's. For businesses that are above the income threshold, your qbi deduction will be the lesser of:. Do Capital Gains Affect Qbi Deduction.

From exoofvqly.blob.core.windows.net

Do Realtors Get Qbi Deduction at Casey Harvey blog Do Capital Gains Affect Qbi Deduction one item that is expressly excluded from the calculation of qbi is capital gain or loss, and therefore, on the. In total, your qbi can’t be more than 20% of your taxable income. qualified business income is the net amount of a business’s income, with a few exceptions. the deduction is limited to the lesser of the. Do Capital Gains Affect Qbi Deduction.

From claytrader.com

Capital Gains Tax Who It Actually Affects... Do Capital Gains Affect Qbi Deduction your taxable income multiplied by 20% — minus net capital gains and qualified dividends. one item that is expressly excluded from the calculation of qbi is capital gain or loss, and therefore, on the. qualified business income is the net amount of a business’s income, with a few exceptions. In total, your qbi can’t be more than. Do Capital Gains Affect Qbi Deduction.

From www.slideserve.com

PPT Tax Reform Basics for the Qualified Business Deduction (Section 199A) PowerPoint Do Capital Gains Affect Qbi Deduction qualified business income is the net amount of a business’s income, with a few exceptions. 20% of the taxpayer’s qualified business income (qbi), plus 20% of the taxpayer’s qualified reit dividends. For businesses that are above the income threshold, your qbi deduction will be the lesser of: the deduction is limited to the lesser of the qbi component. Do Capital Gains Affect Qbi Deduction.

From www.thetaxadviser.com

Optimal choice of entity for the QBI deduction Do Capital Gains Affect Qbi Deduction under this overall limitation, a taxpayer's qbi deduction is limited to 20% of the taxpayer's taxable income in excess of any net. Investment income, such as capital gains or. qualified business income is the net amount of a business’s income, with a few exceptions. qbid is the lesser of: one item that is expressly excluded from. Do Capital Gains Affect Qbi Deduction.

From slideplayer.com

IRC 199A Overview Qualified Business Deduction ppt download Do Capital Gains Affect Qbi Deduction qbid is the lesser of: Investment income, such as capital gains or. For businesses that are above the income threshold, your qbi deduction will be the lesser of: qualified business income is the net amount of a business’s income, with a few exceptions. your taxable income multiplied by 20% — minus net capital gains and qualified dividends.. Do Capital Gains Affect Qbi Deduction.

From slideplayer.com

Standard Deduction Qualified Business Deduction ppt download Do Capital Gains Affect Qbi Deduction For businesses that are above the income threshold, your qbi deduction will be the lesser of: one item that is expressly excluded from the calculation of qbi is capital gain or loss, and therefore, on the. qualified business income is the net amount of a business’s income, with a few exceptions. your taxable income multiplied by 20%. Do Capital Gains Affect Qbi Deduction.

From aghlc.com

What you need to know about the QBI deduction Do Capital Gains Affect Qbi Deduction one item that is expressly excluded from the calculation of qbi is capital gain or loss, and therefore, on the. qbid is the lesser of: your taxable income multiplied by 20% — minus net capital gains and qualified dividends. In total, your qbi can’t be more than 20% of your taxable income. the deduction is limited. Do Capital Gains Affect Qbi Deduction.

From www.physiciantaxsolutions.com

How to Maximize the QBI Deduction as a Physician Do Capital Gains Affect Qbi Deduction For businesses that are above the income threshold, your qbi deduction will be the lesser of: 20% of the taxpayer’s qualified business income (qbi), plus 20% of the taxpayer’s qualified reit dividends. In total, your qbi can’t be more than 20% of your taxable income. your taxable income multiplied by 20% — minus net capital gains and qualified dividends.. Do Capital Gains Affect Qbi Deduction.

From www.financestrategists.com

Capital Gains Deduction Overview, Calculations, and Rules Do Capital Gains Affect Qbi Deduction 20% of the taxpayer’s qualified business income (qbi), plus 20% of the taxpayer’s qualified reit dividends. the deduction is limited to the lesser of the qbi component plus the reit/ptp component or 20 percent of the taxpayer's. qbid is the lesser of: For businesses that are above the income threshold, your qbi deduction will be the lesser of:. Do Capital Gains Affect Qbi Deduction.

From slideplayer.com

IRC 199A Overview Qualified Business Deduction ppt download Do Capital Gains Affect Qbi Deduction 20% of the taxpayer’s qualified business income (qbi), plus 20% of the taxpayer’s qualified reit dividends. qbid is the lesser of: under this overall limitation, a taxpayer's qbi deduction is limited to 20% of the taxpayer's taxable income in excess of any net. the deduction is limited to the lesser of the qbi component plus the reit/ptp. Do Capital Gains Affect Qbi Deduction.

From slideplayer.com

QBI nonSSTB Chapter 1 pp ppt download Do Capital Gains Affect Qbi Deduction Investment income, such as capital gains or. qualified business income is the net amount of a business’s income, with a few exceptions. In total, your qbi can’t be more than 20% of your taxable income. For businesses that are above the income threshold, your qbi deduction will be the lesser of: qbid is the lesser of: one. Do Capital Gains Affect Qbi Deduction.

From legalsuvidha.com

ALL ABOUT CAPITAL GAINS AND THEIR DEDUCTIONS Legal Suvidha Providers Do Capital Gains Affect Qbi Deduction 20% of the taxpayer’s qualified business income (qbi), plus 20% of the taxpayer’s qualified reit dividends. Investment income, such as capital gains or. For businesses that are above the income threshold, your qbi deduction will be the lesser of: In total, your qbi can’t be more than 20% of your taxable income. the deduction is limited to the lesser. Do Capital Gains Affect Qbi Deduction.

From kalfalaw.com

Capital Gains Deduction Eligibility for Proprietors Kalfa Law Firm Do Capital Gains Affect Qbi Deduction under this overall limitation, a taxpayer's qbi deduction is limited to 20% of the taxpayer's taxable income in excess of any net. In total, your qbi can’t be more than 20% of your taxable income. 20% of the taxpayer’s qualified business income (qbi), plus 20% of the taxpayer’s qualified reit dividends. For businesses that are above the income threshold,. Do Capital Gains Affect Qbi Deduction.

From www.youtube.com

Understanding How to Calculate the 20 QBI Deduction YouTube Do Capital Gains Affect Qbi Deduction the deduction is limited to the lesser of the qbi component plus the reit/ptp component or 20 percent of the taxpayer's. qbid is the lesser of: Investment income, such as capital gains or. your taxable income multiplied by 20% — minus net capital gains and qualified dividends. For businesses that are above the income threshold, your qbi. Do Capital Gains Affect Qbi Deduction.

From www.msn.com

Capital Gains Deduction Overview, Calculations, and Rules Do Capital Gains Affect Qbi Deduction qualified business income is the net amount of a business’s income, with a few exceptions. the deduction is limited to the lesser of the qbi component plus the reit/ptp component or 20 percent of the taxpayer's. 20% of the taxpayer’s qualified business income (qbi), plus 20% of the taxpayer’s qualified reit dividends. For businesses that are above the. Do Capital Gains Affect Qbi Deduction.